The Best UX Design Practices for Finance Apps in 2025

Introduction

Did you know that 73% of consumers say user experience is the most important factor in deciding whether to stick with a digital financial service? As finance apps become more embedded in users’ lives, expectations around design, personalization, and functionality are increasing rapidly.

For leaders at enterprise financial services companies—Directors, VPs, SVPs, and Heads of Product or Digital—understanding what defines the best finance apps in 2025 is essential to maintaining relevance and competitive edge. This list highlights the most important, practical UX design for fintech principles you can implement now to meet user expectations and stay ahead of the curve.

In this guide, you’ll get insights into the leading fintech UX practices—from biometric onboarding and cross-platform consistency to the adoption of conversational interfaces. Whether you’re enhancing your banking app UX or launching a new product, these takeaways will help you build a more intuitive experience—and a more resilient business.

The List

1. Design for Trust and Transparency

Trust is foundational in digital finance. Your banking app UX must help users feel secure and in control when managing sensitive transactions. This starts with clean layouts, visible security indicators, and accessible support. Elements like real-time alerts and user-managed privacy settings reinforce transparency and control.

A strong financial UX design builds confidence by ensuring the user experience is simple, reassuring, and responsive—key traits of the best finance apps in today’s market.

2. Minimize Friction in Onboarding

Great fintech UX begins the moment a user launches your app. In 2025, users expect onboarding to be nearly instant. Use progressive disclosure, biometric logins, and QR authentication to simplify the process.

Effective banking app UX design reduces drop-offs and improves activation rates. Prioritize simplicity, mobile-first design, and a flow that inspires user trust right from the first interaction.

3. Prioritize Microinteractions and Visual Feedback

Small animations and cues—called microinteractions—enhance usability and reinforce system responsiveness. In digital banking UX, these details show users what’s happening behind the scenes and improve clarity.

Whether through button animations or visual progress indicators, thoughtful microinteractions elevate the overall banking UX design by making it feel dynamic, responsive, and human-centered.

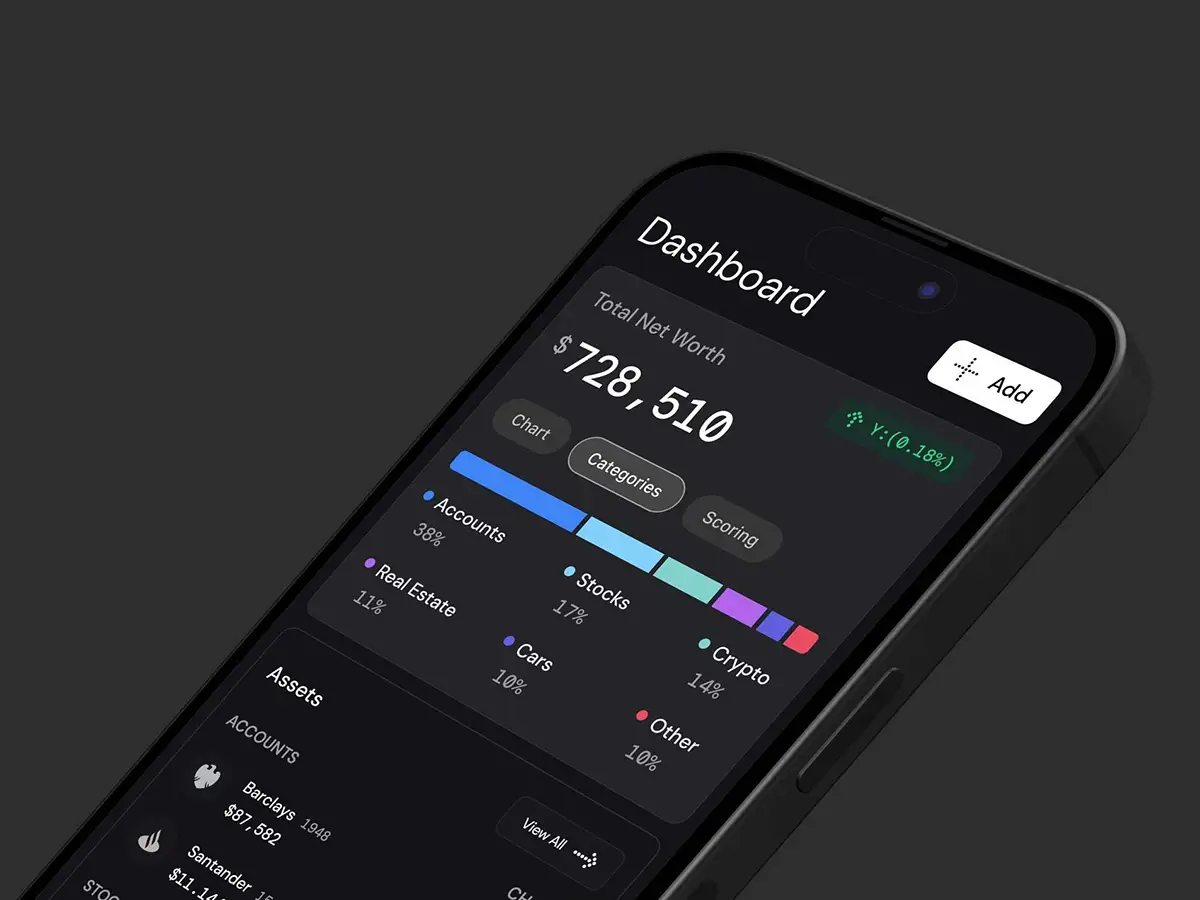

4. Enable Hyper-Personalization with AI

Users now expect financial tools that reflect their unique needs. By integrating AI-driven features like smart dashboards, goal tracking, and custom insights, UX for financial services can become both functional and deeply personal.

Fintech UX design must support adaptive layouts and predictive logic to tailor content and workflows to the individual. In this context, personalization isn’t optional—it’s foundational to building lasting engagement.

5. Optimize for Cross-Platform Consistency

Users switch between devices frequently. If your app lacks consistency across desktop, tablet, and mobile, users will feel disconnected. Unified design systems make it easier to deliver a seamless experience everywhere.

Strong banking UX design supports multi-device continuity, allowing users to start an action on mobile and complete it on desktop without disruption. This consistency is critical in modern UX design for fintech.

6. Design for Financial Wellness, Not Just Transactions

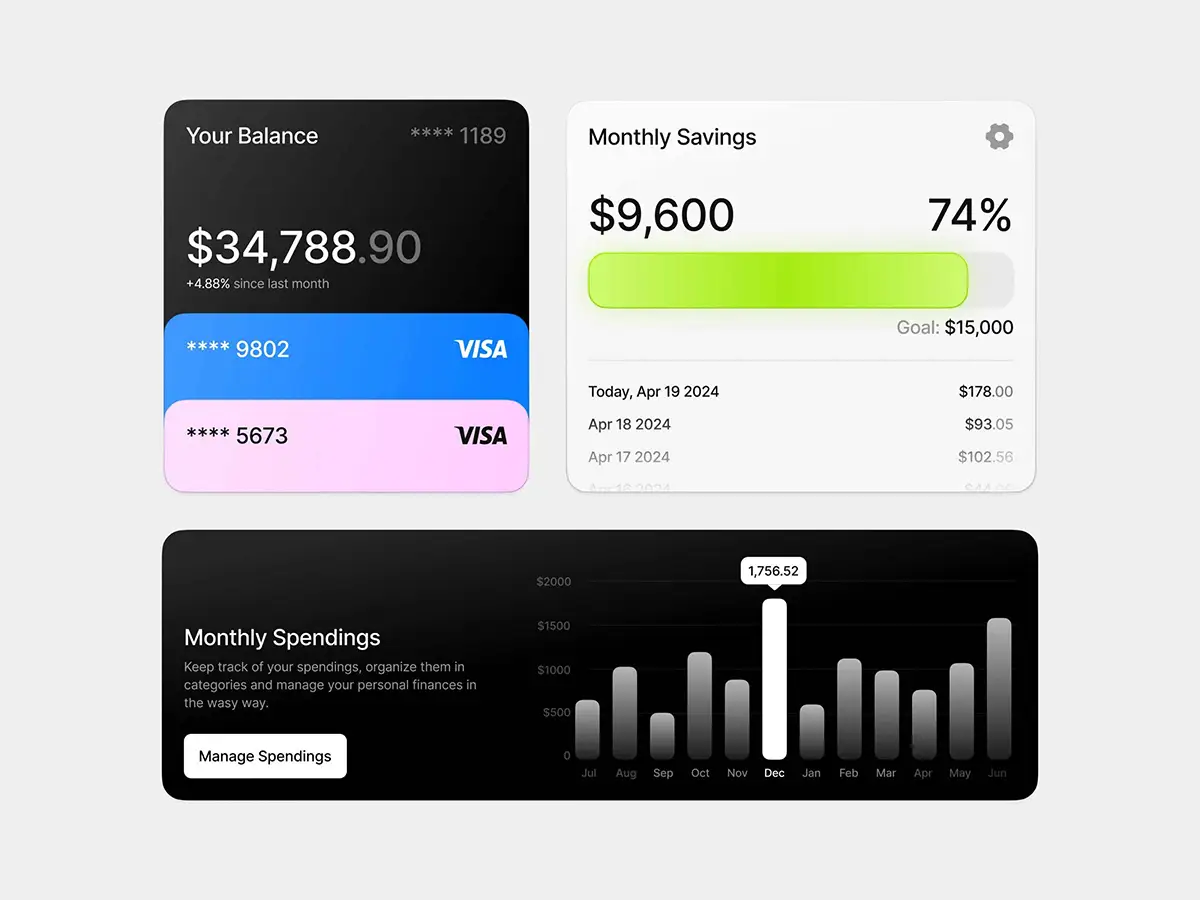

The best bank UX goes beyond transactional efficiency. It encourages users to manage finances holistically—through budgeting tools, net-worth tracking, and goal-setting features.

By embedding financial education and wellness-focused features, fintech UX becomes more than utility—it becomes a trusted companion. The most successful financial UX design meets users where they are and helps guide smarter financial behaviors over time.

7. Integrate Voice and Conversational Interfaces

Voice commands and chat interfaces are on the rise in financial services. Integrating these tools into your banking app UX improves accessibility and speeds up user flows.

Whether for balance checks, quick transfers, or customer support, conversational interfaces are redefining digital banking UX, particularly for users seeking faster and more intuitive ways to interact with their finances.

8. Don’t Ignore Accessibility and Compliance

Accessibility is essential—not just for legal compliance, but for ethical and inclusive design. Color contrast, screen reader compatibility, and error messaging must be core to your fintech UX design.

Inclusive UX for financial services ensures that users of all abilities, devices, and languages can successfully navigate your platform. In a competitive field, accessibility and compliance are markers of quality and professionalism.

9. Test Continuously with UX Analytics

To maintain the best bank UX, continuous improvement is key. Leverage heatmaps, funnel analysis, and user surveys to gather behavioral insights.

A/B testing and usability research help validate ideas before launch. Strong banking UX is never finished—it evolves through iterative testing and ongoing learning.

10. Collaborate with Strategic UX Partners

Executing sophisticated banking app UX design often requires expertise beyond internal teams. Partnering with firms like G & Co. brings access to proven methods, experienced designers, and delivery at enterprise scale.

From discovery workshops to complete UX design for fintech overhauls, external partnerships help you accelerate impact, reduce risk, and stay aligned with business objectives.

Let’s kickstart the conversation and design stuff people will love.

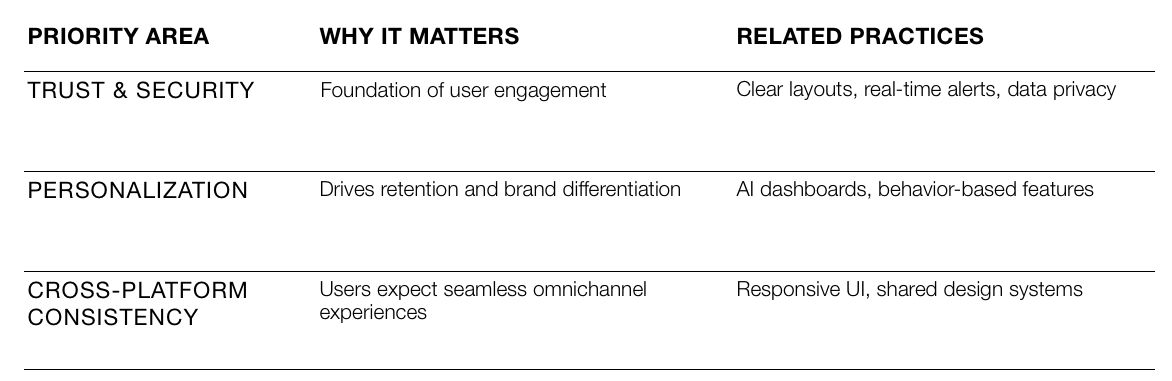

Visual Summary: Top 3 Practices to Prioritize in 2025

Strategic Commentary

One theme unifies these best practices: the shift from utility-driven apps to relationship-based design. Today’s digital banking UX must empower, educate, and adapt in real time. Simply offering functionality isn’t enough—users want a partner in their financial journey.

As technologies like voice, AI, and mobile evolve, the pressure to deliver exceptional banking UX grows. Yet many firms still underinvest in this area or treat UX as secondary. In 2025, leadership teams must recognize that fintech UX is not a side feature—it’s a direct contributor to retention, trust, and growth.

Conclusion & Next Steps

In 2025, the line between financial services and digital experience continues to fade. By applying these ten practices, your team can elevate the experience—and value—of your finance app. From onboarding to AI-driven insights, every element of fintech UX design should serve the user first.

Begin by auditing your current banking app UX and prioritizing three areas for improvement. Then, explore how G & Co. can help you apply best practices and reimagine your digital journey.

Need help turning these ideas into results? Start the conversation with G & Co.

%20(1).png)